There are many types of raw materials required for PCB production, mainly materials such as copper clad laminate (CCL), prepreg (PP), copper foil, copper ball, gold salt, ink, dry film and so on. Generally speaking, in the cost structure of PCB, about 37% of copper clad laminates, 13% of prepregs, 8% of gold salt, and 5% of copper foil copper balls, the cost of labor is also relatively high at about 11%, and the proportion of raw materials for different types of products Slightly adjusted.

Copper clad laminates are made of substrates with different thicknesses by bonding the upper and lower surfaces of prepreg (PP) with copper foil under high temperature and pressure conditions, while prepregs are mainly a sheet shape synthesized from glass fiber cloth, resin and additives. Bonding material. Depending on the thickness of the copper clad sheet, glass fiber cloth accounts for 25% to 40% of the cost, resin cost accounts for 25% to 30%, and copper foil accounts for 30% to 50%. Due to the high concentration of the copper-clad board industry, strong bargaining power, and smooth transmission of prices to the PCB industry, overall, the cost of PCB companies is more sensitive to the prices of the upstream main raw materials such as electrolytic copper foil, fiberglass cloth, and synthetic resin. The price increase effect will bring great pressure to the profitability of PCB companies.

Copper foil prices fluctuate at high levels, supply and demand will ease in the second half of the year

Affected by the rising demand for lithium battery copper foil from new energy vehicles, this round of copper foil companies actively converted to lithium battery copper foil, and the standard copper foil used for the production of PCBs decreased, resulting in rapid price increases for copper foil since early 2016. There are differences in production equipment and technology between standard copper foil and lithium battery copper foil. Lithium battery copper foil has fewer processing steps, simple process treatment, and higher gross profit than standard copper foil for PCB. With the promotion of China’s new energy vehicle encouragement policy, the production volume of new energy vehicles has expanded, and the demand for copper foil as a negative electrode carrier for lithium-ion batteries has also increased dramatically, and domestic and foreign manufacturers are more enthusiastic about converting. According to the estimates of the Copper Clad Laminate Industry Association, in 2015, Taiwan, Japan, and South Korea produced 62,000 tons of lithium battery copper foil, accounting for 30.62% of the total output of electrolytic copper foil. In 2016, China added 167,000 tons of lithium battery copper foil (including conversion), making the standard copper foil account for the total annual production capacity of domestic electrolytic copper foil from 82.3% in 2015 to 79.8% in 2016. .

The price of copper foil is mainly composed of copper price and processing fee. Judging from the trend of international copper prices, copper prices have started to rise since the beginning of 2016 and reached historical highs in the second half of 2017. The domestic Shandong Jinbao announced on July 5, 2017 that the copper price per ton of copper was raised by 1,000 yuan; on July 11, 2017, Willybond Electronics also announced a 2,000 yuan / ton increase in copper foil. During the same period, about 157,000 tons of copper foil withdrew from the FR-4 supply chain, which accounted for about 31% of the total standard copper foil, resulting in a serious contraction in the supply of copper foil for PCB production and copper foil processing fees. grow rapidly. Since the beginning of 2018, copper prices have retreated slightly at high levels, but copper foil processing fees have not been adjusted.

New copper foil production capacity will be gradually released from the second half of 2018 as soon as possible, partially alleviating the pressure on supply and demand in the upstream and downstream. The difficulty in expanding copper foil lies in the titanium cathode roll production equipment imported from Japan. Japanese manufacturers usually do not expand cathode rolls due to increased demand for copper foil. The tight supply of equipment has led to an increase in the copper foil production cycle from 1.5 to 1.5 years. According to the statistics of the Domestic Copper Clad Laminate Industry Association, there were 69,000 tons of new electrolytic copper foil capacity released in 17 years, of which 81.2% was lithium battery copper foil capacity; in 18 years, 7 domestic copper foil companies added 6. 850,000 tons of production capacity, of which 89.1% is lithium battery copper foil capacity, so by the end of 18 lithium battery copper foil market is likely to oversupply.

The price increase of copper foil is the main driving force for the price increase of copper clad laminates. It is indirectly transmitted to PCB companies through copper clad laminates. Through sensitivity analysis, each 10% increase in copper foil prices will increase PCB costs by 1.6% to 2.35%. . Copper foil belongs to a capital-intensive industry, mainly for large-scale production, with a relatively high market concentration and strong bargaining power for downstream. Rising copper foil prices will put a lot of pressure on downstream costs.

Industry cycles add environmental pressure, two-wheel drive glass fiber cloth prices

The capital-intensive glass yarn industry has a highly concentrated market and strong bargaining power. Glass fiber yarns are calcined in a kiln to form a liquid from raw materials such as silica sand. They are drawn into extremely fine glass fibers through extremely small alloy nozzles, and then hundreds of glass fibers are entangled into glass fiber yarns. The investment in the construction of the kiln is huge. For a capital-intensive industry, a kiln with a capacity of 30,000 tons requires 400 million yuan, and it takes 18 months to build a new kiln. Around half a year, production must be stopped for maintenance, and entry and exit costs are huge. The fiberglass cloth industry has a relatively high concentration. 70% of global production capacity is concentrated in five companies, including China Boulder, OCV, NEG, Chongqing International and Taishan fiberglass. In China, China Boulder, Taishan Fiberglass, Chongqing International, Shandong Fiberglass, Sichuan Weibo and Changhai have concentrated 80% of the country’s production capacity.

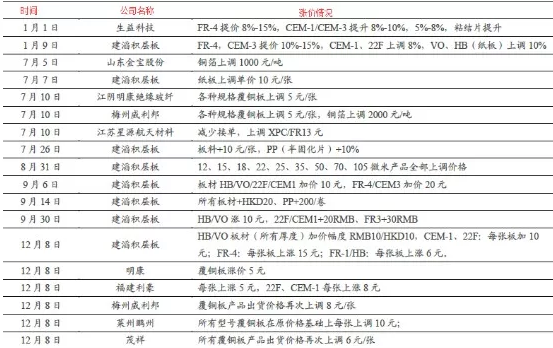

The price of electronic fiberglass cloth has increased nearly three times since the third quarter of 2016. Taking 7628 cloth for thick plates as an example, the average price in July 2016 rose only 3.2 yuan / meter to 8 in April 2017. .7 yuan / meter, approaching a historical high of 10.6 yuan / meter in 10 years. The following table shows the price increases announced by several major suppliers in 2017.

The reasons for the rise in glass fiber prices can be summarized as the following four points:

Glass fiber manufacturers dominate the supply-side production capacity shrinkage: the glass fiber industry is highly concentrated, with obvious cyclicality. With the continued downturn in the early market of glass fiber electronic yarn / electronic cloth, many enterprises with pool kilns give priority to the development of glass fiber roving products. The number of new glass fiber electronic yarn pool kilns has been reduced, and only 50,000 new Taishan glass fiber companies have built domestically The ton glass fiber yarn pool kiln was ignited in November 2015. In 2016, Taishan glass fiber and Chongqing International Shanghai base glass fiber spun yarn kiln were shut down one after another, reducing a total of 38 thousand tons of electronic glass fiber spun yarn. In addition, a cold-repaired glass fiber yarn pool kiln was shut down at the Chongqing International Headquarters base, and the industry’s electronic glass fiber yarns saw a slight decline in capacity. With the limited production capacity of electronic fiberglass yarns, supply and demand tend to be tight in the short term.

The pressure on environmental protection has increased, and the shrinking production of imitation cloth has caused the relationship between supply and demand of electronic fiberglass gauze to change.

Under the guidance of the new industrial policy, the production capacity of electronic fabrics tends to be concentrated by enterprises with glass fiber kiln, which causes increased storage pressure for professional electronic fabric production factories.

Since the beginning of 18 years, some fiberglass cloth prices have begun to loosen. We learned from the market that the thickness of 7638 cloth and 2116 cloth for heavy plates decreased greatly, with an average decrease of 5% to 18%; the price of fiberglass cloth for thin plates remained high. The kilns that were cold-repaired in the early stage have started to ignite one after another in 18Q2, and the production capacity has gradually been released. The factor that has a relatively large impact on the supply side this year will be environmental protection and production limit.

Resin prices remain high

Synthetic resin has become one of the important raw materials for copper clad laminates because of its good mechanical properties, electrical properties and bonding properties. Different types of PCBs have different requirements for resins: Generally speaking, single / double-sided boards, multi-layer boards, and HDI are mainly made of phenolic resin and epoxy resin, and high-speed / high-frequency boards are mainly made of polytetrafluoroethylene. Halogen copper clad laminates use environmentally friendly non-brominated resins. At present, mainland and Taiwan suppliers mainly provide phenolic resins and epoxy resins.

In addition to the rising demand for downstream epoxy resin, there are two other reasons: raw materials and environmental protection. In terms of raw materials, the upstream industry of epoxy resins (mainly oxychloropropane and bisphenol A) is closely related to the trend of global crude oil prices. Crude oil prices have continued to rise this year, and resin prices have continued to hit record highs. Environmental protection is mainly due to non-compliance with environmental protection requirements of many manufacturers in Huangshan, Shandong and other places, leading to reduced production and production suspension, or increased production costs to meet environmental protection requirements, thereby promoting the continued rise in epoxy resin prices.

The price of upstream raw materials directly affects the price of copper clad laminates

As the most basic material of PCB, copper-clad board is also called base material. When it is used for multilayer board production, it is also called Core. It is mainly divided into two categories: rigid copper clad (CCL) and flexible copper clad (FCCL). According to the downstream requirements for different performance, it is further divided into different types of copper clad. From the current market demand of copper clad laminates, there will be four major trends in the future:

(1) Meet the environmental protection requirements of lead-free and halogen-free;

(2) Lightweight, high strength and thinner;

(3) Meet future high-frequency and high-speed requirements;

(4) It can adapt to more complicated working environments, such as high heat resistance and corrosion resistance.

At present, Japan, the United States and Europe have focused on small and sophisticated areas such as composites and special substrates.

In 2016, the global rigid copper clad laminate market increased from USD 9.37 billion in 2015 to USD 10.12 billion in 2016, with an annual growth of 8.0%. In addition, the copper clad laminate market has a high degree of concentration. Since 2013, the top ten PCB companies in the world have been occupying more than 70% of the market share, and reached 74% in 2016. However, the increase in production capacity was too slow, and the compound growth rate from 2013 to 2016 was only 2.2%. The supply-demand relationship between the copper clad laminates and the PCB industry has become tense since the end of the year.

The largest wave of price increases for copper clad laminates was from the end of 2016 to the third quarter of 2017, with the average price soaring rapidly from 101 yuan / piece to 200 yuan / piece. Since the end of 2017, the price of copper clad laminates has loosened, and after a period of fluctuation, it has basically dropped to 170 yuan / piece. In January 18, Jiantao took the lead in announcing the price increase notice, but from the perspective of downstream procurement, the price increase has not been maintained for a long time, and it has not been implemented in downstream large-scale purchase orders. Beginning at the end of 2018, copper-clad laminate manufacturers began to reduce prices, with an average price reduction of about 5%. However, since late May, downstream PCB orders have significantly recovered from the off-season. In June, overall order scheduling was tight, and major copper-clad laminate manufacturers began to send price increases again. We expect that the overall price increase of copper clad laminates this year will be limited. In the third quarter of 2018, some new capacity of copper clad laminates will be gradually released, and the supply and demand relationship with downstream PCB companies will be further eased.